Introduction

Copper has been a valuable resource for centuries, used in everything from electrical wiring to plumbing. Recently, it has gained traction as a viable investment option. In this guide, we will explore the benefits of copper bars, how to invest in them, their use in various industries, and answer common questions. By the end, you’ll understand why copper is worth considering in your investment strategy.

The Value of Copper

Copper is one of the most important commodities in the world. Its versatility makes it a staple in several industries, leading to its consistent demand. Here are some key points about the value of copper:

- Conductivity: Copper is an excellent conductor of electricity, used in electrical wiring and electronics.

- Durability: It is resistant to corrosion and has a long lifespan, making it valuable for construction.

- Scarcity: As mines deplete, the supply may become limited, driving up prices.

Benefits of Investing in Copper Bars

Investing in copper bars comes with numerous advantages:

- Hedging Against Inflation: Copper, like gold and silver, can act as a hedge against inflation.

- Portfolio Diversification: It adds variety to your investment portfolio, reducing overall risk.

- Long-Term Demand: The rise of electrical vehicles and renewable energy will likely increase demand for copper.

How to Invest in Copper Bars

There are various methods to invest in copper bars:

- Physical Purchase: Buy copper bars from dealers or online sales platforms.

- ETFs: Invest in exchange-traded funds that specialize in copper mining companies.

- Futures Contracts: Engage in futures trading for those comfortable with market fluctuations.

Where to Buy Copper Bars

To buy copper bars, consider the following options:

| Seller Type | Example | Notes |

|---|---|---|

| Online Dealers | APMEX | Convenient, often lower prices. |

| Local Coin Shops | Any local establishment | Personalized service, immediate possession. |

| Auction Sites | eBay | Potential for deals but requires caution. |

The Risks of Investing in Copper Bars

As with any investment, there are risks involved:

- Market Volatility: Copper prices can fluctuate based on global demand and economic conditions.

- Storage Costs: Physical bars require secure storage, possibly incurring additional fees.

- Liquidity Issues: Selling physical copper might be less liquid compared to stocks or ETFs.

Using Copper Bars Beyond Investment

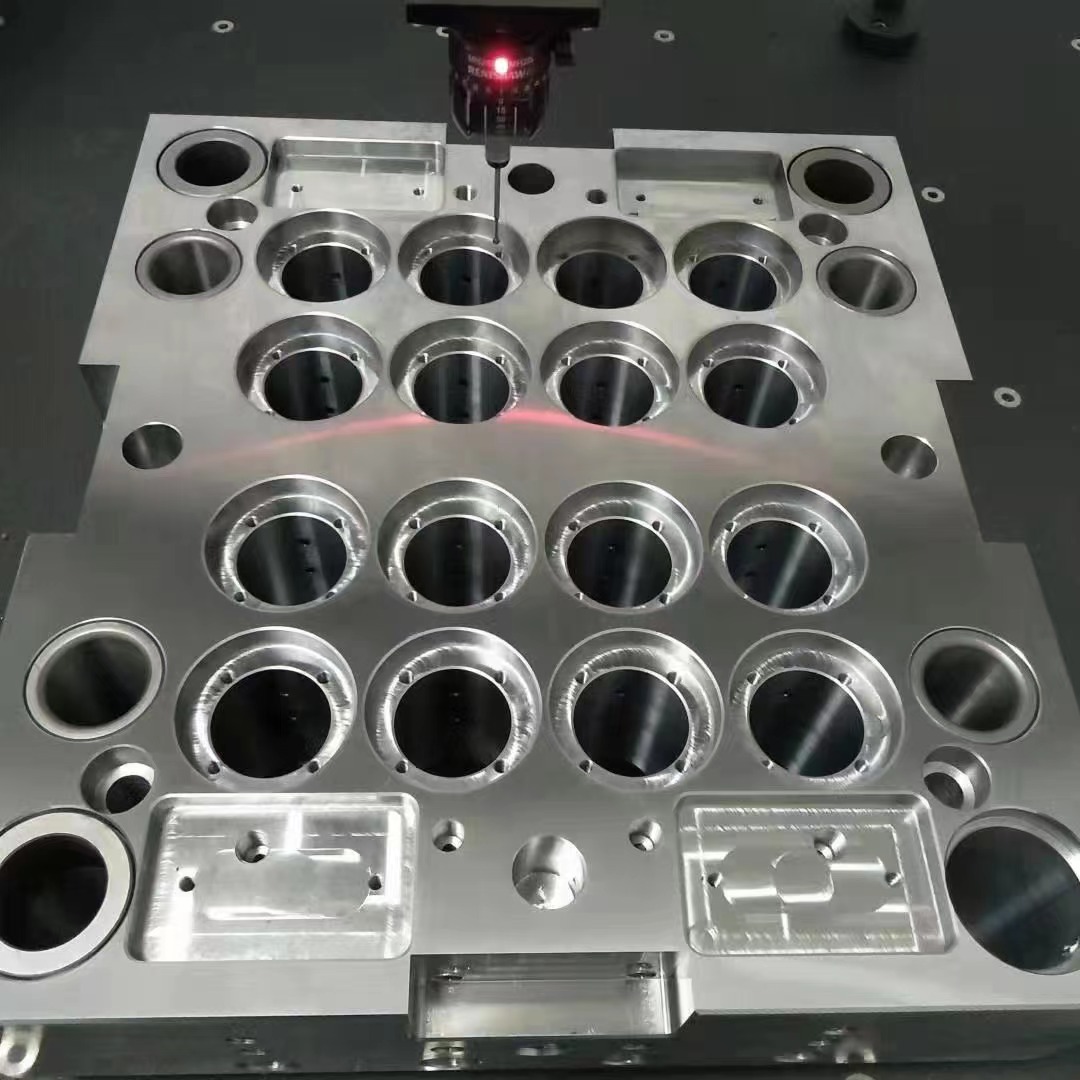

Aside from investment, copper bars find utility in various applications:

- Electrical Applications: Used in wiring systems and electrical components.

- Crafting and Art: Artists and artisans often use copper in sculptures and decorative items.

- Traditional Medicine: Copper is thought to have health benefits, such as reducing inflammation.

Conclusion

Investing in copper bars offers numerous benefits, including providing a hedge against inflation, diversifying your investment portfolio, and capitalizing on increasing demand in various industries. While it offers unique opportunities, it’s essential to understand the risks involved and proceed with due diligence. As with any investment, a well-informed approach is key. Copper’s role in our economy and daily life ensures that it remains a critical commodity with lasting value.

FAQs

1. Is investing in copper bars a good idea?

Yes, investing in copper bars can be a good idea for those looking to diversify their portfolios and capitalize on the rising demand of copper in various industries.

2. How do I store copper bars safely?

Storing copper bars securely in a safe or safety deposit box is recommended to protect against theft and damage.

3. Can I sell my copper bars easily?

While you can sell copper bars, liquidity may vary, and it’s advisable to sell to reputable dealers or through auction platforms.

4. What determines the price of copper?

The price of copper is driven by global demand, supply issues, and overall economic conditions.